Home mortgage calculator with extra principal payments

ARMs usually come in 31 ARM 51 ARM or 101 ARM. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

After the initial teaser period the rate changes annually.

. Easily calculate your savings and payoff date by making extra mortgage payments. This means higher mortgage payments once interest rates increase. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

Enter your loan information and find out if it makes sense to add additional payments each month. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. How much you originally borrowed to purchase your homeWhen you make extra mortgage payments youre reducing this initial loan.

To calculate your mortgage principal simply subtract your down payment from your homes final selling price. Unlike investment properties you cannot use future rental income to help you qualify. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator.

Our early mortgage payoff calculator shows you how much interest you save by making extra payments and calculates your early mortgage payoff date. Four alternatives to paying extra mortgage principal. The CUMIPMT function requires the Analysis.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. Its popularity is due to low monthly payments and upfront costs. Mortgage Amount or current balance.

After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. The principal is the amount of money you borrow when you originally take out your home loan. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.

Here are just a few of the key benefits. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

Thus most homeowners should plan to adjust the budget as the loan matures. Our Excel mortgage calculator spreadsheet offers the following features. For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years.

Calculate the monthly or weekly fortnightly payment. Allows extra payments to be added monthly. Check out the webs best free mortgage calculator to save money on your home loan today.

In the example above after one year of additional payments the principal amount would increase to 13700. The amount of time youve agreed to pay off your mortgageFor example a 30-year mortgage would have a loan term of 30 years. The loan is secured on the borrowers property through a process.

Mortgage Payoff Calculator Extra Payments. Term of the loan. Assuming you have the Loan amount term APR in three cells E5 E6 E7 we can use the PMT function to calculate the periodic payment.

NerdWallets early mortgage payoff calculator figures out how much more to pay. Shows total interest paid. Any extra payments you make bring down the outstanding principal of your loan thus bringing down the loan term.

Pay this Extra Amount. Owning a home without a mortgage is financially liberating. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

How to Use the Mortgage Calculator. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs.

Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage. Extra Mortgage Payment Calculator 47. For Excel 2003.

Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. Our calculator includes amoritization tables bi-weekly savings. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or annually.

2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Consider how long you plan on living in the home. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Pay off your mortgage early by adding extra to your monthly payments. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Biweekly Mortgage Calculator with Extra Payments.

30-Year Mortgages and Extra Payments. Initial loan amount. That includes your primary mortgage payments second mortgage payments auto loans and other ongoing debts.

Then examine the principal balances by payment total of all payments made and total interest paid. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals.

The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. While analyzing the various methods of making extra mortgage payments consumers should consider their individual financial status. The mortgage amortization schedule shows how much in principal and interest is paid over time.

Learn the benefits and disadvantages of paying off your mortgage faster. For example lets say that you buy a home for 300000 with a 20 down payment. Enter the principal balance owed.

The amount of time saved on the current loan schedule by making additional payments. 360 original 30-year term Interest Rate Annual. See how those payments break down over your loan term with our amortization calculator.

The calculator updates results automatically when you change. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

In this instance youd put 60000 down on your loan. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Excel Mortgage Calculator Spreadsheet For Home Loans Buyexceltemplates Com

Free Interest Only Loan Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Mortgage Payoff Calculator With Line Of Credit

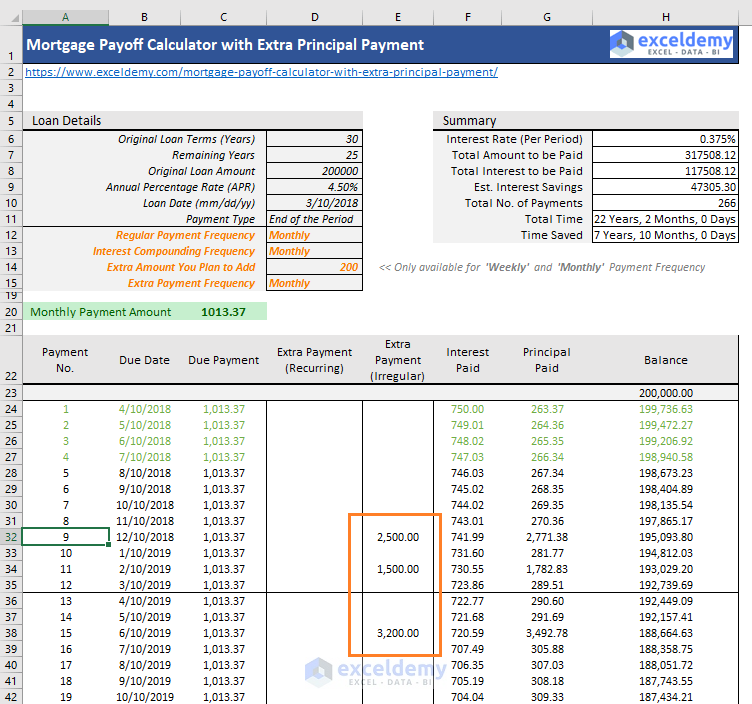

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Calculator With Extra Payments Mycalculators Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Excel Mortgage Calculator Spreadsheet For Home Loans Buyexceltemplates Com

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments Payment Schedule

All In One Interest Only Loan Calculator Financeplusinsurance

Mortgage Amortization With Paydown Savings Calculator Spreadsheetman Spreadsheet Gallery